Two Reasons Why

The ultimate long-term investments are those capable of performing well under opposing inflationary and deflationary economic influences. Today's wealth of macro, fundamental and technical reasons to be a gold and silver owner have never been better. We are currently in an ongoing monetary and fiscal science experiment in the global economy. This experiment reinforces the notion that we have entered into a brand new secular bull market in precious metals in the last year and a half.

There is no doubt that the Central bankers (CB's) in both the US and Canada (The whole of the G20, actually) are cornered into choosing between only two harmful outcomes. On one side, CB's could decide to continue expanding their balance sheets to ensure restrained interest rates at the cost of setting off an inflationary problem.

Listen to "Hard Money," our weekly radio show, or you have followed our articles as of late. You will understand how dear the idea of inflation is to me and how much of a burden I believe inflation is to our wealth. I still think it's inflation but let me make room for a second option.

CB's could also take the deflationary route by reversing their unparalleled loose monetary policy due to overheating economic pockets, resulting in a reckoning moment for financial assets from record valuations. Think housing prices, commodities, food, gas, stock valuations etc.

Let me go a step further. Although I believe there are two possible outcomes, I think that the much greater probability will be inflation, as do my colleagues at Delta Harbour. Inflation accompanied by a low economic growth environment (i.e., stagflation). However, for now, let us contemplate the possibility of deflation as a way of understanding the likely implications that investors may face.

To achieve deflation, I believe there is one key component to watch/consider. That is the secular decline in money velocity (Investopedia-"The velocity of money is a measurement of the rate at which money is exchanged in an economy. It is the number of times that money moves from one entity to another. It also refers to how much a unit of currency is used in a given period of time. Simply put, it's the rate at which consumers and businesses in an economy collectively spend money.")

An example of this comes from the Japanese economy. While the Bank of Japan has grown its balance sheet from 21% to 135% of its nominal GDP since 2000, the average annual increase in the country's Consumer Price Index (CPI) has been a mere 0.1%. Wages and salary growth have remained muted under an ageing population, which remains a big problem. Also, the technological advancements witnessed over those years mitigated the price increases in consumer goods and services. It is talked about often but is rarely considered an example.

Very few economists believe we stand to suffer the same outcome, although we have a very similar setup in place as we speak, especially in Canada. During that time, the 2nd largest economy in the world, Japan, was also surpassed by China, with Germany not far behind them.

So the question we might ask is, does such a deflationary setup even matter for gold and silver owners? Let us again look at Japan as an example.

Despite all these deflationary factors, gold and silver in Japanese yen terms drastically diverged from money velocity, each appreciating over 4+-fold in the last two decades.

Escalating Inflation Despite a Secular Downward Trend in Money Velocity

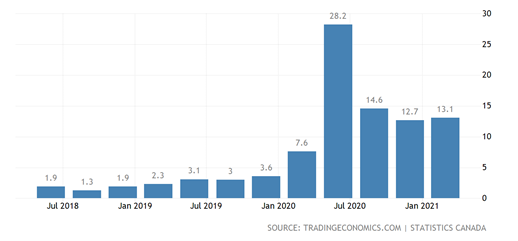

When money velocity plunges, the private sector's eagerness to hoard money rather than spend it tends to worsen deflationary forces in an economy. For example, over the past 12-15 months, Canadians have stashed some $100 billion into savings. This has temporarily increased the savings rate to as high as 28.2% in that time.

To add to this predicament, near-zero interest rate strategies also cause financial institutions to become hesitant to lend capital to private institutions. We are seeing clear signs of that today. Commercial and industrial loans are down 16-20% from a year ago, the most significant annual decline since the global financial crisis of 2008-09.

Nevertheless, like any other well-formed comprehensive view of a marketplace, I try not to depend on just one referent or point. There were plenty of examples in history of other economies that went through similar secular plunging trends in money velocity and faced inflationary difficulties. Turkey and Brazil would be great examples. Both economies suffered from significant currency devaluations while also experiencing the pressure of a rising consumer price environment. Let us turn the page to the other side of the argument; the impact of inflation on gold and silver.

The Argument for Inflation

Today's massive list of inflationary drivers, running on all cylinders, is quite wild:

- $3.9 trillion added to the US Fed's balance sheet since January 2020, almost doubling its size.

- In Canada, we've printed the largest single 12 month total at $400 billion in 2020 and have now increased our Federal debt to over $720 billion.

- The continuous need by policymakers to suppress interest rates and allow the government to spend WW2 size deficits while accumulating record amounts of debt, now at 140% of GDP in the US and 117% in Canada.

- The most significant wealth transfer from the government to the people in history, with the net worth for US households, including the bottom 50%, increasing by the largest amount in history, while in Canada, our CERB and "CERB-like" payouts and net social expenditures have increased the amount in Canadian savings accounts by $100 billion.

- Over ten years of under-investment in natural resource industries creating a long-standing bottleneck in the supply of commodities being experienced right now with higher prices for just about every type of commodity.

- In Canada, a significant amount of money on the sidelines is estimated at approximately 1 trillion, while in the US, near $3 trillion of accumulated personal savings, almost twice the size of the prior historical peak.

- Lack of investment alternatives that yield more than inflation has resulted in a significant loss of purchasing power in the past 12 months.

- Helicopter money policies are creating severe implications with labour shortages. At last check, some 600,000 jobs remain unfilled in Canada.

- A clear deglobalization trend is developing with worsening US-China relations adding pressure on global logistics.

- The likely beginning of an upward move in commodities from near historic low-price levels.

- The hesitancy by significant energy and metals producers to replenish their reserves through new exploration and development projects creates long-term implications in raw materials supply.

- The rise in popularity of the New Green Agenda and ESG principles constraining the exploration and production of certain commodities.

- The willingness of policymakers to overshoot their inflation goals with extreme stimulative programs is now happening worldwide. US Inflation 3%-4%, Canadian inflation now 5%-6%

- Companies being pressured to increase wages and salaries to attract workers to return to the labour market.

The So-called "Temporary" Selloff in Commodities

What troubles us the most is the reality that policymakers have become remarkably complacent when it comes to believing that today's record monetary and fiscal stimulus will not result in more prolonged lasting inflation. We happen to be on the other side of that bet. It is dreadful how a Fed member with an inflation forecast of 2.5% for the end of 2022 is now considered hawkish these days. The same thing can be said of the CB in Canada. Once the flood gates of allowable inflation are opened, the rest is just modification to the ongoing narrative. The CB's will justify the higher rates of inflation with terms like "transitory" or "temporary," which will make way for terms such as "short to medium-term." This will inevitably make way for higher interest rates and eventually a significant recession, which we have avoided for a historically long time now.

What if I warned you that I believe the only temporary move we likely had was in the recent selloff in commodity prices, including our gold and silver markets during the summer doldrums? We think the hoarding of tangible assets by investors is just getting started.

Do As I Say, Not As I Do

We chatted about the above title on "Hard Money" just a few weeks back here: https://www.youtube.com/watch?v=w0mtt6MEA58

It is a remarkable contradiction that the Fed on both sides of the border decided to pivot the market narrative to their willingness to tapering, though not raising interest rates until 2023. Meanwhile, the Federal Reserve just reported that it added the biggest amount of assets to its balance sheet in over a year in the US. Nearly $200 billion in the last four weeks. In their own words:

"The Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals."

It looks like the "at least" part came in handy this time around. It was the opposite of a taper. If we could use the perfect parallel to describe their message for raising interest rates in plain words, it would be the "we are pondering if we should start a diet two years from now."

The alarming aspect of this buying is that the FED themselves in the US buy these up using money they print, which the public taxpayer will owe. The same thing is, of course, also happening here in Canada. Even scarier is that nominal yields rose recently in the face of larger purchases of Treasuries by the Fed in the US and Canada. This tells you in, in part, why policymakers are genuinely trapped.

Debt to Real Economic Growth-The Scary Ratio

The latest increase in US government debt relative to economic growth has been astonishing. To put this into perspective, since January 2020, real GDP has risen by approximately $114 billion. Meanwhile, during the same time, government debt increased 43x that amount. This was perhaps the most inefficient use of capital that we have seen in history.

In Canada, we are estimating the same type of outcome, but it could be far worse.

The last time real yields touched such low levels was in the 1970s when policymakers called for a "war on inflation." Today, they are welcoming it with open hands. Again do as I say, not as I do. In my opinion, this is one of the most bullish macro setups for gold and silver in over fifty years.

The Start Of Something, Not The End

Imagine suggesting that gold and silver are at their peak prices and in a bubble today. Well, there are loads of investors, economists, bankers and analysts in that camp. It is essential to zoom out and look at the multitude of reasons to own tangible hard assets. In an environment of rising inflation, where most financial assets are at record valuations and yield less than inflation expectations, gold and silver can offer substantial value and near-term high growth.

Silver: Undervalued Growth Opportunity

We challenge hard asset owners to find a hard asset that is:

- Used as frequently as silver is

- Has among the smallest amount of actual geographical resources available

- Has among the smallest of primary providers for a natural resource (80% of it comes out of the ground compliments of gold, copper and other types of mining)

- Has as many potential usages, and demand centers

- Has TRUE industrial inelasticity (DELL is not going to stop making a computer because silver all of a sudden shoots up to $50 Oz)

- Has the brightest future ahead of it with the growth of green technologies in electric vehicles and solar energy growth

Silver's Industrial Strength

Silver leads the industrial demand for precious metals, and the bulk of its yearly demand comes from industry. The growing investor demand is something that has yet to be unleashed. The silver mining industry is also on track to report approximately 15 of the last 20 or so years in deficit supply, meaning much has come from stockpiles, which no longer exist or from recycling to make up the shortcoming.

The "Transitory" Indoctrination for Gold and Silver

The US and Canadian CB's talked down inflation expectations in June with their "inflation is transitory" crusade and hawkish Fed meetings and one-trick headlines in their conglomerate of self-serving media outlets. It was a one-two punch for gold, silver, and other commodities that should prove all bark and no bite in the short run. Notice they also mentioned nothing about gold and silver's seasonality. We were about the only firm to do so, yet it is a significant part of what occurs in June.

We believe it is a gift that has formed a fantastic entry point today and that gold and silver prices are primed to be reversing back up post-June/July.

CPI is a Falsehood

The disinformation campaign also caused a countertrend move in the stock markets primarily, a swing that is still in its early innings in our analysis. This move has happened before and is likely to prove short-lived, as there is little backing from the dominance of fundamental and macro data.

Undeniably, inflation is a much more significant obstacle than is being conceded by policymakers and voice drones in the media. Take, for example, this. According to a recent Fannie Mae survey, real estate investors in the US expect rents to be up 7%, but the Bureau of Labor Statistics (BLS) in the US tells us that Owner's Equivalent Rent (OER) is up only 2.1%. Moreover, the BLS dares to make OER the most significant component of the Consumer Price Index, giving it a 24% weight, which is ridiculous. Skewed stats, which the public never questions, provide uneven outcomes which impact the public directly. How is that for irony?

In the meantime, actual home price inflation runs at an insane 23.6% annualized rate in the US. It is also running at 20-30% here in Canada. Both the US and Canada's government CPI statistics are a disgrace.

Delta's Overall Positioning and the 4 Fundamentals.

We remain focused on both gold and silver at present, with silver being the more undervalued of the two metals. Product is still very much available in most forms of bar and coin with some exceptions, but the narrative of a shortage is still premature, in our opinion. In some cases, wait times for product delivery have been slightly more elongated. Still, the product continues to flow through Delta Harbour and into both direct home delivery and storage accounts with little to no interruptions. As many of you have read, this contradicts what many analysts and other dealers have reported. Fear-mongering is NOT a good reason to buy a hard asset.

I maintain that the politicians lack focus on the real and very disruptive possibility that their economies will not defend themselves well without massive liquidity injections as life support. However, their printing regimes will require a pause nearing year-end and into 2022 and beyond.

What outcomes we will witness will be dependent on what lies ahead for interest rates, inflation, GDP organic growth and our overall willingness to admit that things must go back to normal once the social nets are withdrawn.

However, we continue to maintain focus on the more critical macro fundamentals in gold and silver as they are the best guides for overall pricing direction:

- Currency Depreciation

- Inflation

- Geo-Politics

- Supply and Demand

Within these four fundamentals are everything I have discussed above and then some, and it boils down to simple common-sense questions. Do you feel your wealth is positioned well? Do you feel comfortable with your current holdings? Do you believe the real estate and stock markets have unlimited potential to increase multiple times higher? Will real estate even move 25% higher as interest rates jump?

A test is coming for our economy. If you answered no to any of these, perhaps it is an excellent time to seek the opinion of others or to research for yourself what gold and silver might be able to offer your wealth strategy. We are always open to discussion and love to hear from our clients and potential clients alike.

Let me leave you with the latest 14-year return averages on silver and gold in all of the major currencies. You might be amazed at how well they have performed.

Yours to the penny,

Darren V. Long