The world financial system is no longer a free marketplace. You have two ways of dealing with it: earn more income or diversify your wealth.

2008 was a valuable lesson for me personally on many financial fronts. It was the first time in my own financial life that I sincerely was at a loss in understanding what went wrong, even though I had been voicing my concerns in writing and on-air, long before that moment. Even though I talked about the potential risks and warned others when the break finally occurred and the “financial crisis” ensued, I still felt blindsided. Thank goodness for balanced wealth and gold and silver. Otherwise, it might have been the most painful financial lesson I ever learnt. Instead, this is what I figured out was a truth we all need to know.

Financial pundits, talking heads, planners and advisors and many of my professional colleagues referred to the last decade as a “windfall” decade. They claimed it provided them with “some of the most incredible opportunities in a lifetime.” It was indeed a great few years, from stocks to cryptocurrencies to all-time high indexes to low-interest friendly investments. The problem is that the average individual investor has not been investing from a position of strength. They have been investing from a position of recovery. Recovery of what they lost when 2008 hit and wiped out 20%, 30%, even 50% and more of their entire nest egg in a couple of weeks. Let me tell you the truth about wealth today as I have experienced it.

The world financial system is NO longer a free capitalist/entrepreneurial/industrialist/consumerist marketplace. Our system is quite the contrary. We now have a system that is referred to as “Crony Capitalism” or “Cronyism.”

(Wikipedia- “Crony capitalism, sometimes called Cronyism, is an economic system in which businesses thrive not as a result of free enterprise, but rather as a return on money amassed through collusion between a business class and the political class.”)

In this system, you disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad, more commonly referred to as bailing out the “too big to fail” institutions and individuals well part of the cronyism itself.

At this moment, there is a fallacy being prolonged by the very banks and financial institutions that we put our faith in to guide economic policy and drive economic growth, and perhaps most important of all, entrust to watch over our finances. We trust that they (the institutions, central banks, bankers, policymakers, politicians) will make the best decisions that bring about the most significant amount of good for the largest number of people.

Examples include low-interest rates to stimulate economic growth, social welfare systems to assist the public in times of need, such as pandemics and so forth, and overall guidance to support our financial goals. In other words, the support required to live the Canadian dream of being successful on any front, from family to wealth and everything in between.

But our system is not only rigged for the cronies but also a system is teetering, not starting, not beginning to, not probably will, but is currently right this minute teetering on the brink of significant change. Moral hazards are markedly increasing because we have been pushed, conned, tricked, duped into borrowing an enormous amount of money from ourselves and, in doing so, jeopardizing our future and that of our children’s futures.

Food is increasing in cost faster than you can eat it. Real estate is up 20% to 30% in a year, depending on your location. Insurance premiums and gas are ridiculous; I just paid a tad shy of $185 for a tank in my F150 (That’s regular). With the once-in-a-lifetime (we expect) floods in British Columbia, the whole supply chain mess has worsened. Container goods are stranded, and according to a reliable client source who has been the head of logistics for a major retailer, it costs their company approximately USD $25000 to land a single container, up from USD $900 on average a few years ago.

Suddenly – almost everywhere – there are growing sections of empty or less dense store shelves. Not just for made-in-China stuff gone from your local Wal-Mart, but also HVAC supplies at Canadian Tire and seasonal items from Home Hardware and Lowes. And groceries in some spots like BC are running so thin that some stores have closed or reduced their hours while trying to get back to normal. Do you still think our bankers are correct in calling inflation “transitory”?

Okay, so shortages, rising prices, shelter costs and an energy crunch could mean this has just started. You have two ways of dealing with it. Earn more income. Or diversify your wealth strategy with more robust assets.

Last week Ottawa revealed its plan for managing. Here are the highlights:

- Index rate for 2022: it’s 2.4% (the amount of inflation reflected in government benefits, tax brackets)

- RRSP max contribution limit: $29,210 (from $27,830)

- TFSA contribution limit increase: 0%. Yet again, it’s $6,000.

In other words, it doesn’t amount to much. Inflation is a tax. For those earning less, a TFSA is essential. RRSPs are a poor second choice when the contribution room is thin, and there’s little (or no) income tax to reduce, but not too bad when the contribution room is more significant, or you’re not an income earner in the top tier tax bracket. Plus, withdrawals later in life might jeopardize government benefits such as monthly OAS income.

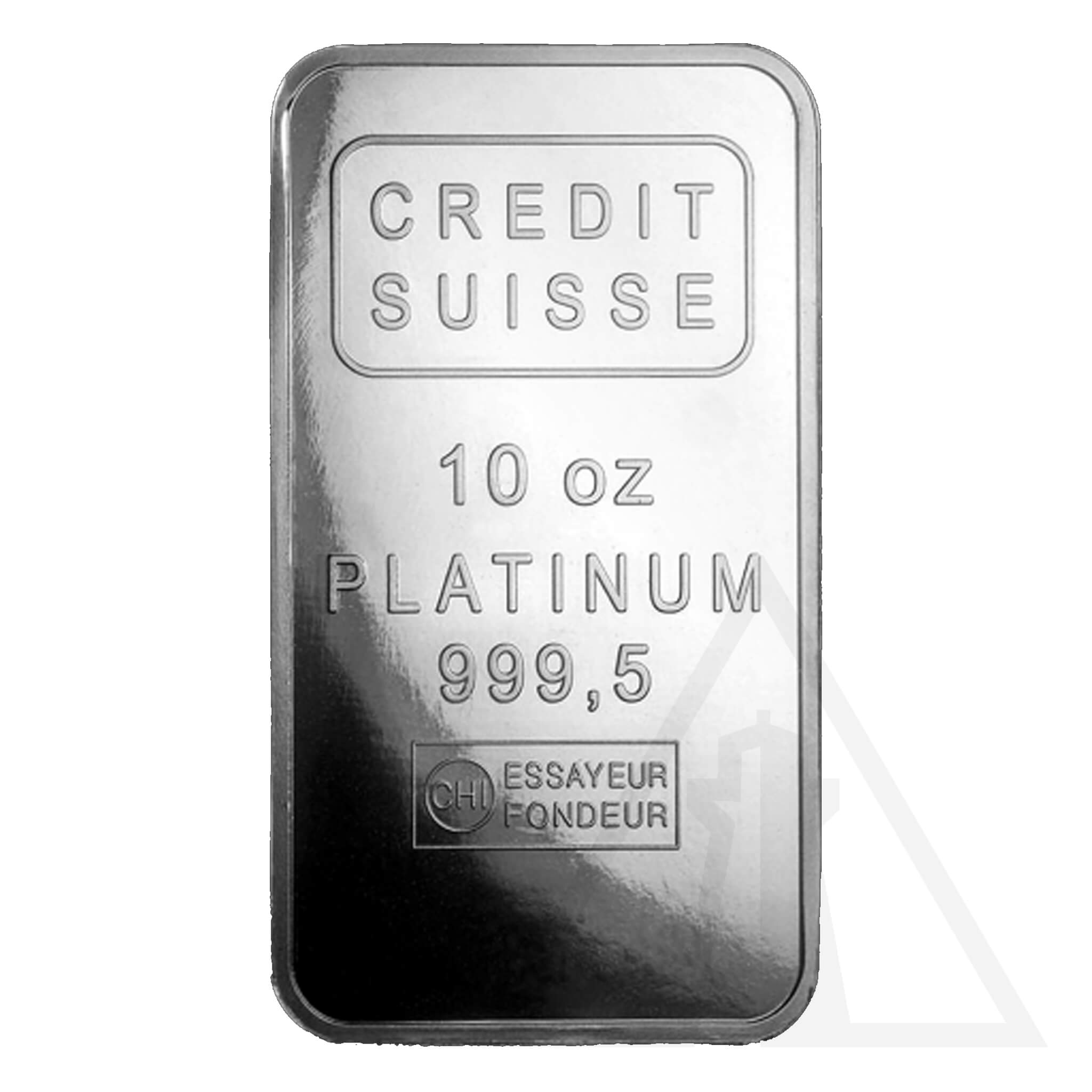

There is no easy way out of this moment. Some of you might be reading sitting on the comfy side of little or no debt, already deciding to diversify your wealth strategy using assets such as gold and silver, but for those who have not yet made that decision, it is scary, and I can relate. It is arduous and uninteresting to sit down and take time to understand your wealth and your reports, and your quarterly updates. I also know the reasons why you might not think of gold and silver as great investments. They don’t pay dividends, which is the favourite way analysts, planners and advisors like to slag gold and silver, and neither metal keeps the snow off your head at night as your house does. These are truths used to distort the very nature of why I have owned gold and silver for almost two decades.

Gold and silver are not going to end inflation. They are not going to replace your other hard assets such as land or real estate. They will never be the only assets you should own, and they should not be counted on to provide you with the same traits as a stock portfolio, bonds and cash.

But, and this is a big but, they have outperformed all of the above at various points in the last two decades. Maybe it is time they get the benefit of the doubt. Think outside of the box, and like the cronies do, own some physical gold and silver.

Yours to the penny,

Darren V. Long