For those reading, you know that interactions with me tend to be upbeat, lifting, thorough, and yes, I do my homework where gold and silver are concerned.

As part of this process, there are moments of ambiguity in the market for gold and silver, which leave us feeling less than optimistic. This is NOT one of those times. However, the current next two years we are now entering are strange for another reason. That reason you ask, is? Recession.

In the good old days, recessions were simply the unpleasant part of the business cycle. Consumer choices, exuberant businesses, and monetary policy would periodically generate growth contractions. We debated the timing, but recessions didn’t come out of the blue.

Then in 2020, a recession did come out of the blue, or nearly so, when COVID unexpectedly changed behaviour. Working from home, avoiding travel, etc., caused a sudden drop in services demand, and thus recession. This wasn’t part of the business cycle.

The last “normal” recession ended in 2009/10, about 13 years ago. As with most unpleasant experiences, we don’t put a lot of energy into remembering what it was like, especially here in Canada since we felt less affected.

The problem is we need to remember to plan for the next one, which is now upon us. Today we’ll remind ourselves of what happens in a typical recession to both the economy and the financial markets. We’ll also look at ways this one probably won’t be predictable. It undoubtedly can be worse.

Last week saw some volatility (the good kind) as stock prices recovered and oil retreated slightly. The basic facts haven’t changed, though. A recession was already a strong possibility even before the Russian/Ukraine conflict began in its most recent incarnation. The genie is out of the bottle even if the war stops. The Russian sanctions will continue, which means the global realignment will continue, too.

Another factor (especially on a month when we are witnessing the end of Ontario mask mandates in much of the province) is China’s growing COVID outbreak, which is already closing some factories and may lead to more supply chain grumbles. Some interpret this bullishly, thinking a China slowdown will reduce energy and commodity prices. That may be correct, but not for more than a few weeks. We face recessionary forces that are much harder to overcome.

I can only see one scenario that would make all this better. If Vladimir Putin loses power and is replaced by someone of a sharply different philosophy, that person quickly leads Russia in a new, more democratic direction. Then the war and sanctions could end, and Russian exports resume. Possible? Yes. But not likely.

That being the case, a recession is where we are heading. So, let’s review what a slump right now might be like.

According to the National Bureau of Economic Research in the U.S., the referee of such things, a recession is “a significant decline in economic activity spread across the economy, lasting more than a few months.” That’s as good a definition as any but still leaves room for interpretation. What is significant? How many months are “a few?”

Our friends at Investopedia point to four specific markers of recession.

- Loss of jobs

- Declining real income

- Production and manufacturing slowdown

- Lower consumer spending

All those are bad individually and worse together. If these markers persist for months, then I, for one, would call it a recession. Remember, though; this will be a strange recession. It doesn’t have the typical causes and may not have the usual effects.

Let’s start with employment. Here is the latest Canadian jobs picture.

The total number of nonfarm jobs increased steadily until the brief COVID recession. Then jobs fell hard and still haven’t fully recovered. The nonfarm jobs report has been making good headway, though. (This is NOT to suggest the quality of jobs is better or the same, and in fact, it is worse overall.)

A longer-term look at this same data series shows employment tends to peak just as recessions (the vertical gray bars) begin. But notice, since 1994, every pre-recession peak was higher than the last pre-recession peak. If the same doesn’t happen this time, we’ll have another reason to call this recession strange.

Regrettably, I think that consequence is probable. Today’s higher energy prices and war-related disturbances will start to bite soon. Businesses desperate to hire right now will see slower sales and stop adding staff. That’s the first step to reducing staff.

As for the second marker associated with recessions, declining real income it’s already occurring. But here again, it’s a strange picture. (Remember, this is inflation-adjusted.)

The chart shows income popping sharply higher in peaks, corresponding to the COVID stimulus. If you generalize the pre-COVID trend-forward, today’s level is about where it should be. But it’s been worsening for several months despite higher nominal wages, partly due to rising inflation. But whatever the cause, people change their behaviour when they perceive it is becoming steadily harder to make ends meet. Consumer sentiment surveys have shown sharp drops, likely due to rising prices caused by supply chain issues and inflation, which impacts us much more in Canada than in the U.S.

Marker three, a manufacturing slowdown, is more brutal to evaluate with COVID and supply chain challenges. But it seems almost sure to decline as the Russia/Ukraine conflict makes components and materials even harder to obtain than they are now.

Also, note it doesn’t take much to disrupt production. The Financial Times had an interesting story last week about automotive wiring harnesses. Various European manufacturers source these from factories in Ukraine. It’s simply a little device to hold the multiple cables that snake through your car’s engine. They’re made to exact specifications. Unable to get them, BMW and Volkswagen, among others, have idled entire plants since the conflict started. That means lost sales, profits, and wages. This example highlights how sensitive the whole global manufacturing base is.

Another example is increasingly scarce and expensive diesel fuel. In Canada, diesel prices have almost doubled from the pre-COVID level, with inventories at multi-year lows. Most are paying about $2 per litre, which is ludicrous, and we all know it.

Europe’s diesel problem is even worse. Quoting from a recent Bloomberg article:

“The loss of Russian supplies is particularly acute for northern Germany, which receives Russian seaborne cargos directly via Hamburg and other ports. In reflecting the crisis, benchmark wholesale European diesel prices hit a new high last week. The premium for diesel for immediate delivery exploded—at one point, it was 100X more than usual—in a sign of extreme tightness.

“The situation is made worse because Europe doesn’t just import finished diesel from Russia, but also semi-processed oil that it further refined to make diesel. The lack of that feedstock, including vacuum gas-oil and straight run fuel-oil, is forcing some refiners to cut supplies. Both Shell Plc and OMV AG have started to restrict their wholesale supplies. OilX, a consultant, has told clients it sees ‘a real risk of physical shortages of diesel in Europe.’ Privately, oil traders and oil companies say the same. No one wants to raise the alarm, fearing a run on gas stations, but everyone is quite worried.”

“If nothing changes, by early April, some European countries may need to restrict diesel sales to conserve supplies.”

We’ll see more such interruptions as the Russia/Ukraine conflicts direct impact and the sanctions against Russia reverberate through the Canadian and U.S. economies. In addition to this is the already tricky situation the world faces with the microchip shortage. The microchip shortage was on the mend but may now worsen again. All this has snowball effects, one of which will be lower output.

The fourth and last component of Investopedia’s definition of a recession is lower consumer spending. This marker is a murky component because the spending mix matters greatly. When people must spend more on food, fuel, and utilities, they have less to spend on other things. We saw with COVID how these shifts could devastate specific sectors. A non-COVID recession will look different but may not be much better. I would not want to bet that we get caught up anytime soon in a balanced spending approach, allowing the middle class to get back to growing instead of shrinking.

How does recession impact your investments? It depends on how you are invested. But broadly speaking, recessions hurt. Stock and real estate prices fall (imagine the impact in Canada with real estate prices so artificially high), interest rates rise, and companies often cut back or halt dividends. Diversification at this point makes such great sense. Owning physical gold and silver is a fantastic idea to achieve this.

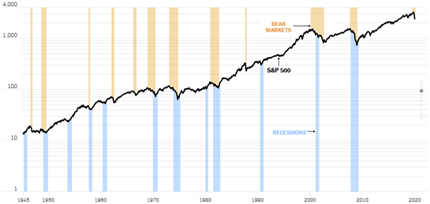

Here’s a fascinating long-term look at the connection. The line in the chart below is the U.S. S&P 500 since 1945 on a log scale. The blue bars are U.S. recessions, and the brown bars are U.S. bear markets. (For the most part, they both line up. If we were to seek the Canadian data, it would look the same.)

You can see recessions and bear markets usually correspond, but not always. Nor are they always of the same duration. In theory, we could have a recession, but stocks continue higher or hold steady. I would not bet on it. And note carefully: What look like minor blips on this very long-term chart are 40% to 50% declines, followed by years making up lost ground. This isn’t a case for buy-and-hold.

The table below shows the maximum drawdowns in the U.S. market during major recessions since World War II. The 2001 and 2007 bears were particularly ugly. Also, note that of 13 instances, the last three are in the top 5 historically. This is a lousy sign moving forward.

Massive Quantitative Easing (Plain ole’ money printing) helped the stock market recover in 2020‒21. Note below the extraordinarily high correlation between stock prices and quantitative easing, beginning on March 23, 2020.

We can assume with relative ease that all of the power-hungry Central Bankers on the Federal Open Market Committee (FOMC) are aware of this correlation. It’s why they only gave lip service to reducing the balance sheet. The same thing can be said here in Canada as you will note below, our balance sheet has ballooned also:

It will be interesting to see how rapidly (or not) the U.S. Fed’s assets fall. Like a “junkie” coming off a drug high, it could drag on stocks and make the bear market generally associated with recessions worse. I know I would not be caught dead without some gold and silver in my portfolio for these reasons alone. Now could be a time when we witness the whole world thinking the same way about gold and silver. As economies weaken, our confidence in Politicians to “do the right thing” will evaporate along with increased bank risk and uncertainty about what the rules going forward are going to be.

The best way to “play” a recession, in my humble opinion, is to view it as a buying opportunity. That means holding cash, gold/silver, and looking for value when paper assets hit their bottoms. The tricky part is that you never know where the bottom is, so today’s value could be an even bigger value next week, which will be the case as the stock markets show increased signs of weakness. That’s frustrating but inevitable. And hopefully, you’re not buying to sell next week anyway. It is better to get a reasonable price and sell in the next bull market when it is absurdly overpriced. Here is what gold and silver did from 2008 – 2011 as the “stock markets” corrected.

Gold +156%

Silver +450%

Everything I’ve stated has outlined the “typical” recession setup. But we already know this one isn’t conventional. I don’t expect it to look like 2000 or 2008 at all. A better analogy would be the 1970s stagflation era.

That was an entirely different world and different kinds of markets. There were no ETFs back then. Mutual funds were a new idea, and the TFSA hadn’t come to fruition. Online trading was science fiction, and there were billions fewer potential gold and silver buyers, let alone nearly 1.5 billion potential Chinese gold and silver buyers! So, it’s hard to visualize how that kind of recession will combine with today’s variety of markets. We haven’t seen anything like it.

It bears repetition: Most recessions are deflationary. Consumer prices decline as growth weakens. That’s one of the traits that makes them tolerable, though not agreeable. Your income falls but so do your living costs. Stagflation isn’t like that. Your income falls while your living costs rise —in this case, due mainly to higher energy costs. (Our country has the means to reduce our energy costs but not the political will to do so as it simply doesn’t result in enough increased votes. Sad, but true.)

We will experience this clearly in our fuel and utility bills and indirectly in many other expenses. In some respects, it will be like a value-added tax, tacked on to prices at every production level. But this is hardly tax reform. At current rates, all the usual taxes will continue, if not higher. Then we’ll have the new energy “tax” on top of them. It won’t matter what Parliament does or how you vote. The tax will be there, and you’ll have to pay it.

So, for now, prepare yourself. Take stock of where you stand. Why did you contact Delta Harbour in the first place? There is something to everyone’s story that is similar, and although we all end up voicing it differently, the common binding theme is there. We know there is a change afoot. We know something is happening, but we can’t quite nail it down. If we experience stagflation, and I am assuming that we will, gold and silver will be on steroids.

Yours to the penny,

Darren V. Long