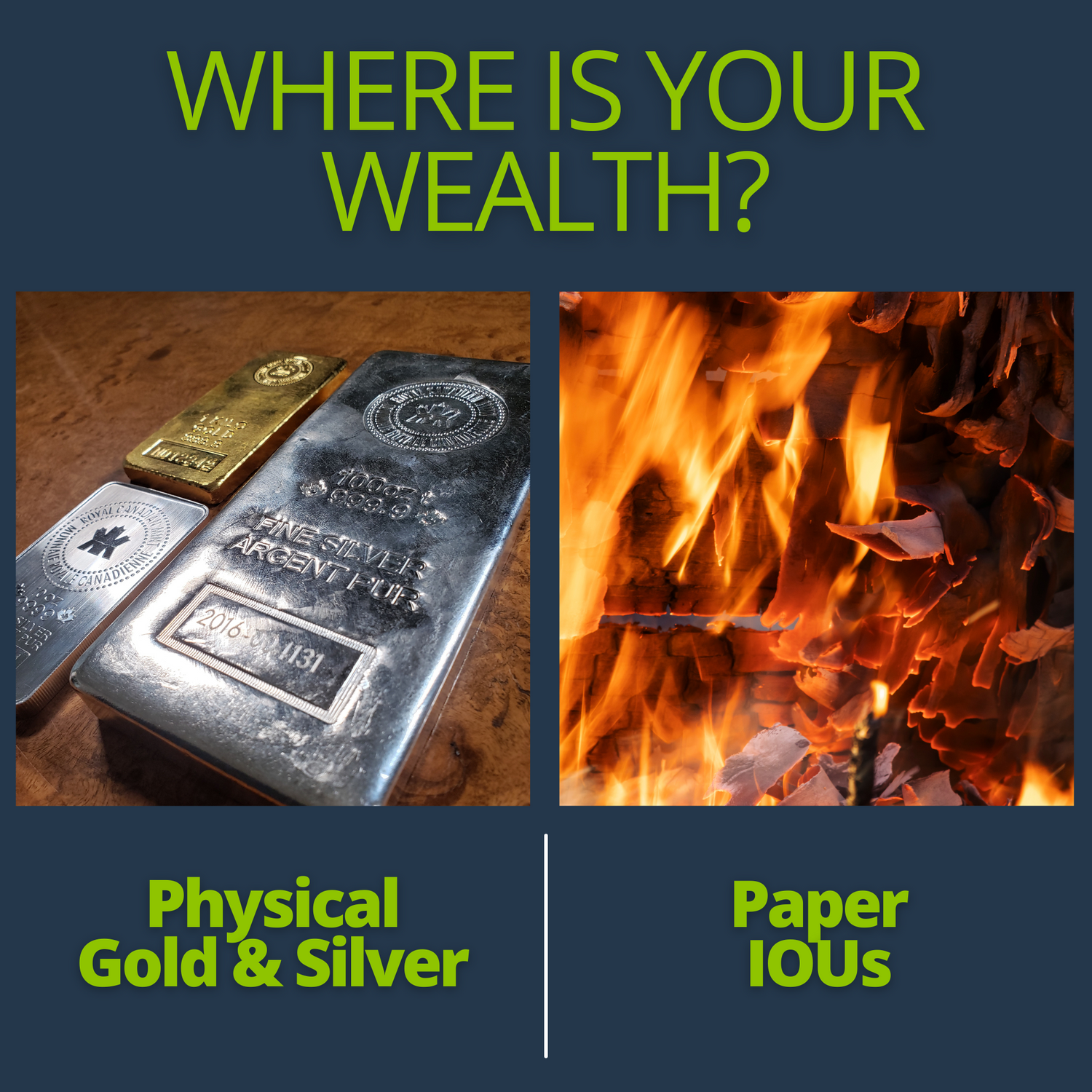

Within the intricate framework of financial literature lies a poignant realization encapsulated on page 13 of the 2023 iShares SLV ETF Annual Report. It reverberates through the corridors of academia and Bay Street, speaking of the delicate balance between perceived value and tangible assets, actual real value. In an age where paper financial instruments weave a complex tapestry of investment opportunities, it is essential to discern between the ethereal promises of paper derivatives and the solidity of physical holdings.

From page 13 of the 2023 Annual Report from the SLV ETF:

"The Trust's lack of insurance protection and the Shareholders' limited rights of legal recourse against the Trust, the Trustee, the Sponsor, the Custodian and any sub-custodian expose the Shareholders to the risk of loss of the Trust's silver for which no person is liable."

In the grand theatre of investment, the allure of gold and silver beckons seasoned investors and neophytes alike. It brings to Delta Harbour plumbers, doctors, Moms, hockey players, lawyers, crossing guards, couples, singles, old and young, and it does so without a single barrier to any geographical demographic. It is the great equalizer of all financial markets the world over. When all else fails, a central bank's gold (and silver) will prevent them from complete and utter inhalation. That's it, that's all.

You may chuckle, but for those who understand economic dynamics, there is a genuine concern around the world right now that tomorrow is not guaranteed in this climate of falsity related to global GDP and economic growth, which is wonderfully predicated on nothing more than a bunch of printing presses running full steam hiding each every next phase with truly imbecilic terms meant to confuse you and lead you astray to the point that you go about your day and bury your head in the sand. We are in trouble, both globally and here in Canada. Mark my words that if you're not doing something proactive with your wealth strategy that is different and creative and involves taking some risk, then you are likely also at risk yourself. Our belief in physical gold and silver ownership is inherently engrained in our actions.

The physical ownership of these precious metals exudes a sense of permanence and security that transcends the transient nature of paper certificates or shares. While the latter may offer the semblance of ownership, they often remain tethered to the whims of market sentiment and the stability of financial institutions. In contrast, holding the physical metal in one's possession confers an irrefutable sense of control and autonomy, free from the constraints of intermediaries and counterparty risks. Furthermore, the intrinsic value inherent in gold and silver endows them with a timeless allure, serving as a bulwark against the erosive forces of inflation and economic volatility. In a world where uncertainty looms, the tangible embrace of physical ownership is a beacon of stability and reassurance.

Delta Harbour Assets finds itself entrenched in the realm of physical assets for a reason deeply rooted in prudence and sustainability. The intricacies of paper derivatives and alternatives, while offering an illusion of accessibility and flexibility, often lack the robustness needed to weather the storms of economic uncertainty. Our commitment to tangible assets stems from a fundamental belief in preserving value and mitigating risk. In a world where trust is a scarce commodity, we offer solace in the tangibility of our holdings, ensuring that every purchase is grounded in the solidity of physical assets, not paper promises.

Yours to the penny,

Darren V. Long