It's time to dust off that old real estate playbook and throw in some financial humour while we’re at it. Real estate used to be the golden goose, but let’s not kid ourselves—it’s more like wrangling a herd of angry cats these days; you’re bound to get scratched and clawed while at it.

I’ve spent years talking about real estate as a "hard asset"—a key part of any diversification strategy—but let’s face it, this isn’t Monopoly money we’re playing with. Real estate isn’t exactly portable or easy to manage. It's fun at first, but after dealing with land transfers, maintenance, building permits, real estate agents, fees and lawyers, you’re just trying to avoid sinking. And if you can squeeze out a 3-5% return after all that sweat, you're a financial wizard. Gone is the FOMO that sent house prices rocketing some 25%+ in some year-over-year markets during the COVID crisis. Nothing right now with four walls means guaranteed profit—unless you’ve got a money-printing machine in the basement.

Now, for the big plot twist: the Canadian real estate market looks as stable as a raccoon on roller skates. Sales are tanking, listings are piling up like dirty laundry, and prices? They’re stubbornly hanging on like your uncle at the open bar. On the other hand, buyers are sitting on the sidelines, hoping for a housing crash or mortgage rates that won’t require them to sell a kidney.

Meanwhile, sellers ask, "Why sell for peanuts when you can wait for a FOMO-driven buying frenzy after the next rate cuts?" They’re holding out like it’s 1999, convinced that the next round of interest rate drops will light up the market like a Black Friday sale. But let’s be honest—where will you live once you sell? Everything costs a fortune anyway. Never before have so many housing markets in Ontario and Canada, for that matter, become so levelled out.

It used to be that I could sell in Vaughan and move comfortably just a bit further north. Now you sell in Vaughan and need to move North of Orillia to find value. You could, just a few years ago, take all that equity in your North York detached and move to Richmond Hill, or Aurora or East and West and pocket the difference. Nope, that’s gone too. During COVID, house flips were so common that you would be hard-pressed to know somebody who didn’t know somebody who was flipping homes with little to no experience. This is now gone.

Welcome to September’s real estate market—frozen like the last burger in the box sitting in the freezer. Prices and buyers are stuck, and everyone waits for the other guy to blink. And despite the Bank of Canada cranking up rates like they’re at a poker game, the market hasn’t flinched. As borrowing costs soared, house prices would plummet, right? Nope. It’s like we threw a rock in the air, and instead of coming back down, it’s just hovering in defiance of physics.

Is it different this time? Not likely, folks. The story’s still unfolding, so grab your popcorn.

Let's sprinkle in some dark humour before we delve into the real estate abyss. Today’s housing stats? Yup, more crickets. It’s a stand-off, a financial staring contest where buyers and sellers are sizing each other up like two moose on an icy lake.

Alright, folks, buckle up because we’re diving into the latest bit of fun in the Canadian banking world—this time featuring RBC, which is currently holding the “uh-oh” trophy for its mortgage exposure. We learned today that RBC is sitting on a whopping $401 billion in residential mortgages. Let that sink in for a second—$401 billion. That’s like trying to juggle flaming chainsaws while riding a unicycle. But here’s where it gets spicy: over $72 billion of those mortgages have amortizations stretching over 35 years.

Yep, you heard right. These lucky turkeys whose fixed monthly payments don’t even cover the interest charges. Sound familiar? Yep, we’re talking about those pandemic-era FOMO loans—many coming straight from our favourite overpriced wonderland of Toronto and the GTA.

When everyone and their dog scrambled to grab a house like it was the last Timmie’s doughnut, RBC was dishing out mortgages like candy at Halloween. But now, with interest rates shooting up faster than a double-double chugged at 7 a.m., those loans are looking a little shaky.

So what does this mean? Well, it’s not just the borrowers feeling the squeeze—RBC’s got some serious skin in this game. With $72 billion in loans where the monthly payments aren’t even touching the interest, they’re holding a ticking time bomb. And if the GTA and, more specifically, Toronto core continues to hover at "ridiculously unaffordable," this could get messy fast.

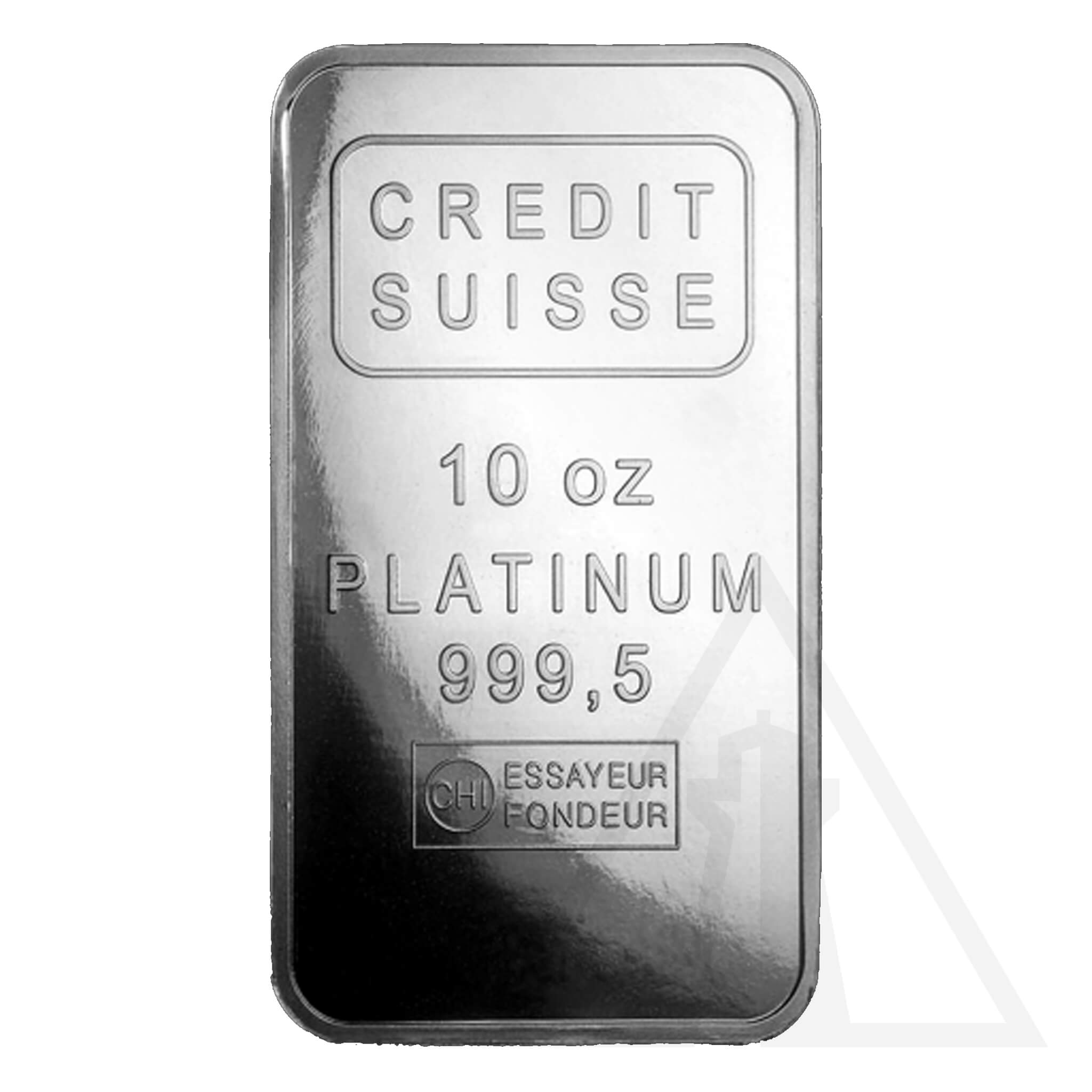

And as for that "soft landing," we keep hearing about? Canada’s economy is more like a car on a 401—full of unpredictable bumps and ruts. This is where the smart folks with a nose for opportunity start considering diversifying. Maybe, just maybe, now’s the time to add a little shine to your portfolio—gold and silver, baby. Unlike your brick-and-mortar investment, AU and AG won’t leave you waiting for mortgage rates to return to earth. And trust me, they’ve got staying power.

However, regarding interest rates, the Bank of Canada dropped another quarter point this week, bringing us down to 4.25%. Rumour has it we’re in for two more cuts in 2024, and mortgage rates might drop to 3.99%, or slightly lower, by spring. Compared to the brutal 6.25% from 2023, that’s a vacation.

So, what’s a so-called “investment buyer” to do? Wait another six months to snag a rate starting with a 2. Maybe. But don’t get too comfortable—by the time those sweet rates roll in, house prices might swell like a balloon at a kid’s birthday party, turning that lower rate into more debt. Yay, mortgage math!

And here’s Ron Butler—our favourite no-nonsense mortgage guru of Butler Mortgages—dropping truth bombs: “Sure, rates are lower, but house prices in Ontario and BC? Still batshit crazy. Do the math on down payments and monthly payments, and buying a house still feels like wrestling a bear with your eyes closed.”

As for investors? Well, the condo market in the GTA is starting to resemble a clearance sale that no one’s showing up to. Even with rate cuts, rental properties still don’t add up. You’d need a 2.49% mortgage rate (or lower!) to break even in today’s market. That ship has sailed, folks.

More cuts are coming, though, and that’s not just a rumour. It’s happening. Why? Because those high rates we’ve been dealing with have the big banks shaking in their boots. They’re stashing cash like squirrels hoarding nuts for winter, prepping for the mortgage renewals in 2025 and 2026. When that wave hits, rate cuts will be the lifeline.

But here’s the kicker: nobody wants cheaper houses. Not the banks, not the realtors, not Bay Street, and not the government. Everyone has a vested interest in keeping prices sky-high. So, don't hold your breath if you’re waiting for a recession to burn it all down and bring prices to their knees. Central bankers have their fingers on the printing press and are not afraid to use it.

Lenders and those renewing mortgages face a more challenging situation in about a year when many loans reach the end of their terms. If the central bank continues cutting rates, bankers and homeowners will catch a break. However, the financial strain could follow if a recession hits or rates rise after the U.S. election.

In the meantime, consider a little glitter in your wealth strategy. No, not the glitter that gets everywhere—I'm talking about the kind that shines like AU and AG. While the real estate market staggers around like a drunk at last call, gold and silver might just be the stability your portfolio needs.1

Take a peek at these charts if you require further evidence of the malfunctioning system: Source: Compare the Market, Australia

Source: Compare the Market, Australia

Keep your stick on the ice. Now you know. What you do with it is always up to you.

Yours to the penny,

Darren V. Long