Gold and Silver: A Proven Legacy in Wealth Preservation

In the most recent of bull markets, the fifth one in the last 100 years, Gold and silver have demonstrated their unwavering capacity to endure and thrive for over two decades now, cementing their status as foundational assets in wealth preservation. Both metals have withstood financial upheavals and emerged stronger, asserting their value as safe havens in volatile markets. The past 20 years have shown gold rising from around $400 in 2004 to peaks above $2,700, and silver climbing from under $5 to notable highs above $49. These movements underscore a larger truth: in the face of persistent challenges, gold and silver hold an enduring allure for those committed to securing their wealth.

The Lessons of Historical Pullbacks and Renewed Faith

Throughout history, gold and silver have faced extreme volatility that tested investors' resolve. A prime example can be traced back to 1976 when gold prices experienced a sharp near 50% decline. Mainstream interest wavered, and many investors lost faith in gold as an asset class. Yet, in a reversal that only gold could accomplish, prices rallied and surged to record highs in January 1980. This cycle has been repeated multiple times, with many different highs and lows, peaks and valleys, tops and troughs, and each recovery building on the fundamentals of scarcity, intrinsic value, and trust in hard assets during economic instability.

Today's market echoes those historical patterns. Recently, both gold and silver have seen pullbacks that have prompted some investors to question their position in precious metals. But for those familiar with the cyclical nature of these assets, this moment is a familiar test. Seasoned investors understand that these dips are not a departure from gold and silver’s long-term trajectory but part of the ebb and flow that has characterized their healthy growth.

Distinguishing Speculators from True Investors

In every bull market, there's a tendency for speculative interest to overshadow long-term strategy. Investors who bought early in the current cycle, only to pull out when prices dipped, reveal themselves as speculators—chasing short-term gains rather than committing to gold and silver's intrinsic value. This kind of “weak hands” investing, motivated by fear during price drops, is the antithesis of value investing. Precious metals are not for those seeking quick profits; they reward those who view them as fundamental components of wealth preservation, not fleeting opportunities.

Gold and silver investors are better understood as value investors, recognizing the unique, time-tested role these metals play in balancing portfolios against currency devaluation, inflation, and economic instability. If you’re among those who purchased in recent months, with gold prices above $2,700 USD or silver at $34.50 USD, you’re positioned in a market largely untouched by the general investing public. Only about 3% of investors worldwide hold meaningful exposure to these metals and those who do understand their value as tangible, irreplaceable assets.

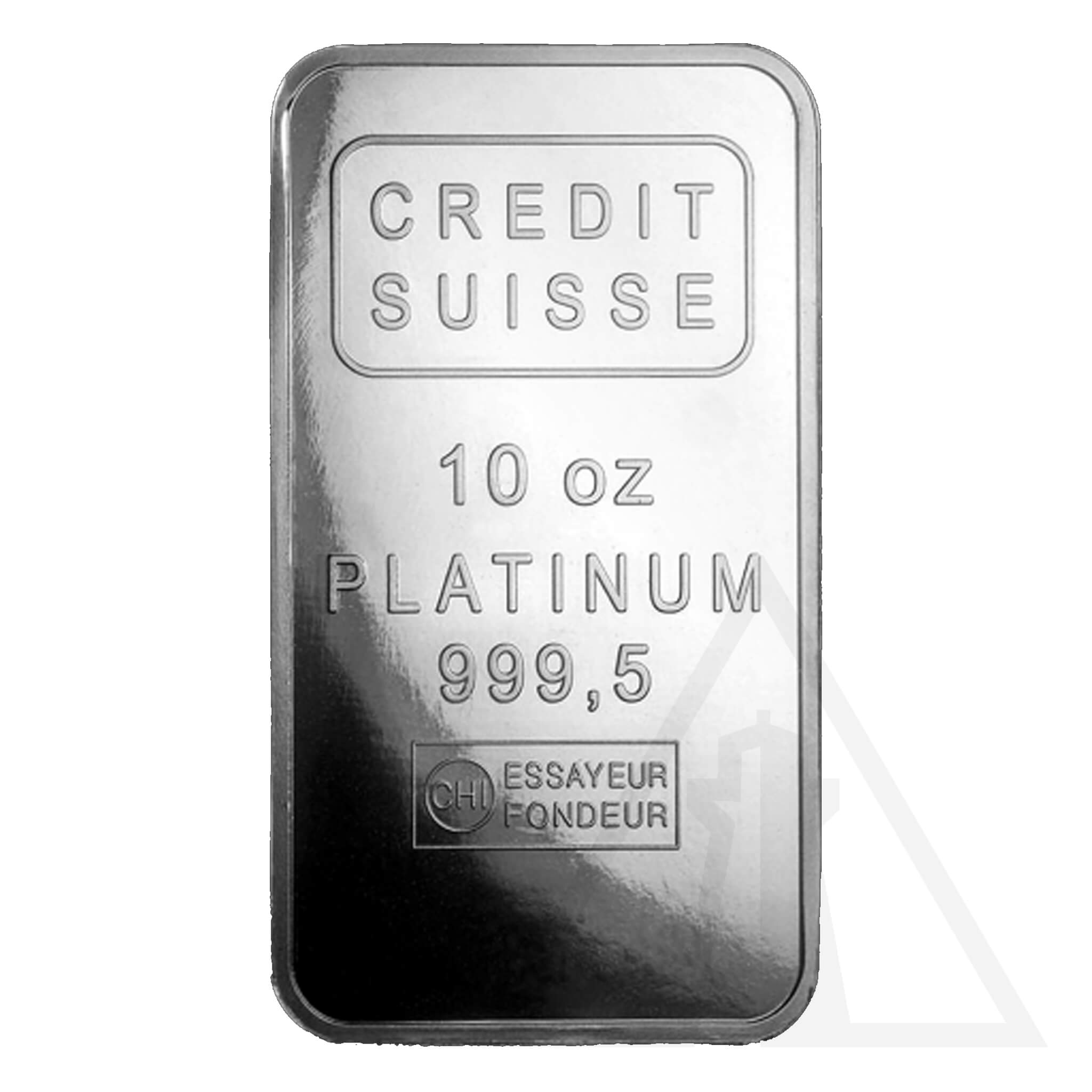

Accumulation: A Strategic Wealth Balance

Gold and silver are indispensable for those dedicated to maintaining and balancing wealth. As my father wisely said, “Never bet against the bank,” and we see this principle echoed in the actions of global central banks. Central banks around the world have maintained and even increased their gold reserves. Russia, for instance, is now adding silver to its reserves, signalling a broader acknowledgment of silver’s long-term value. These institutions understand what too many individual investors overlook: precious metals are a critical hedge in any diversified strategy. They protect wealth in a way that no fiat currency or purely paper asset can.

Those who genuinely grasp the value of gold and silver see opportunity in a price dip rather than panic. They know that moments of uncertainty in precious metals markets are invitations to strengthen their positions. Like the world’s most prudent investors—central banks—they use these moments to acquire more.

Congratulations to the Committed Investors

To those who have accumulated gold and silver in recent months, congratulations are in order. By investing now, you’re taking part in a time-tested strategy for wealth preservation that has stood firm through every economic storm. And as history has shown, your commitment to precious metals will likely be rewarded as global trends continue to affirm their relevance.